- Home

- Sustainability

- Environment

- Climate Change

Climate Change

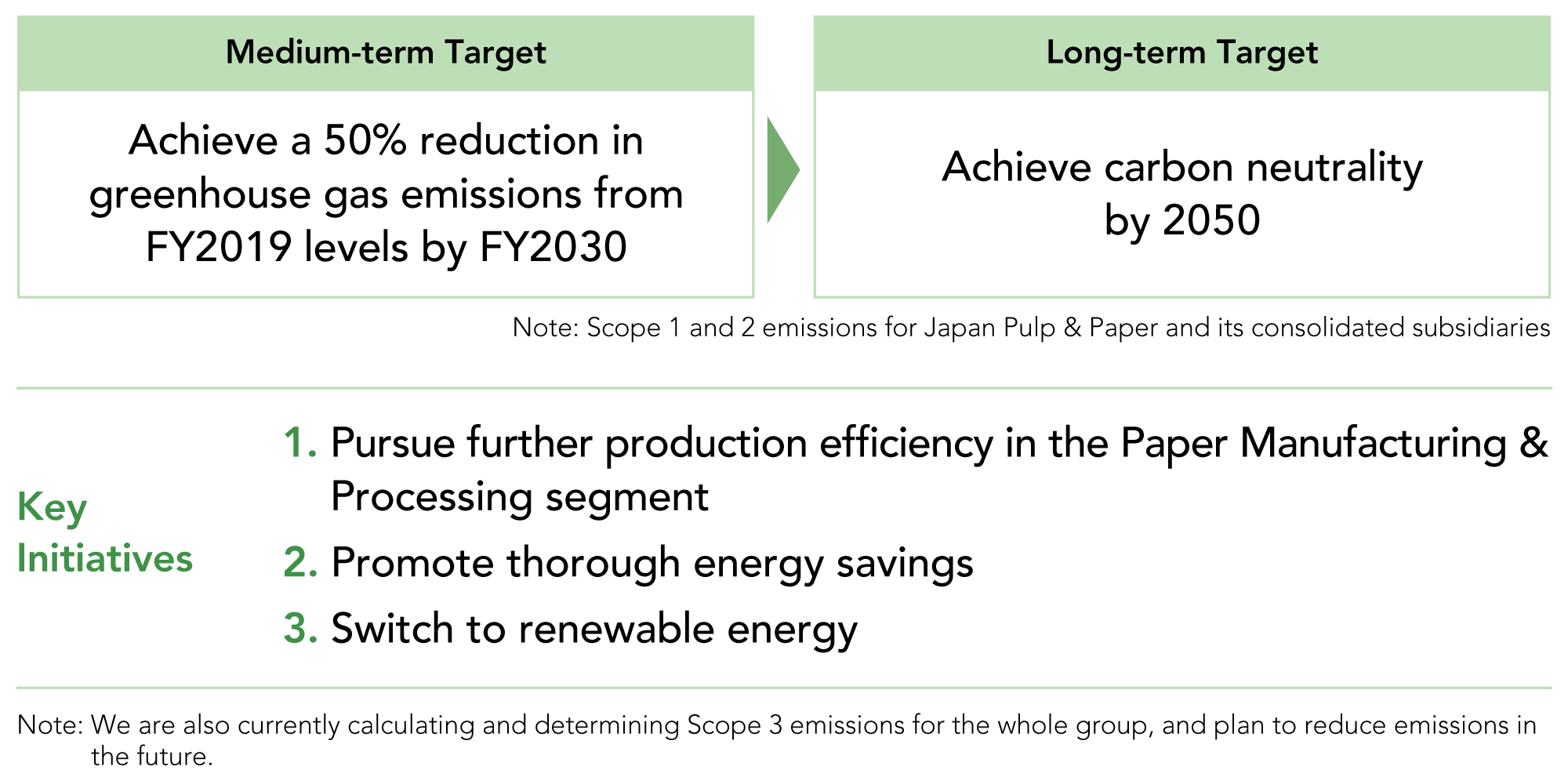

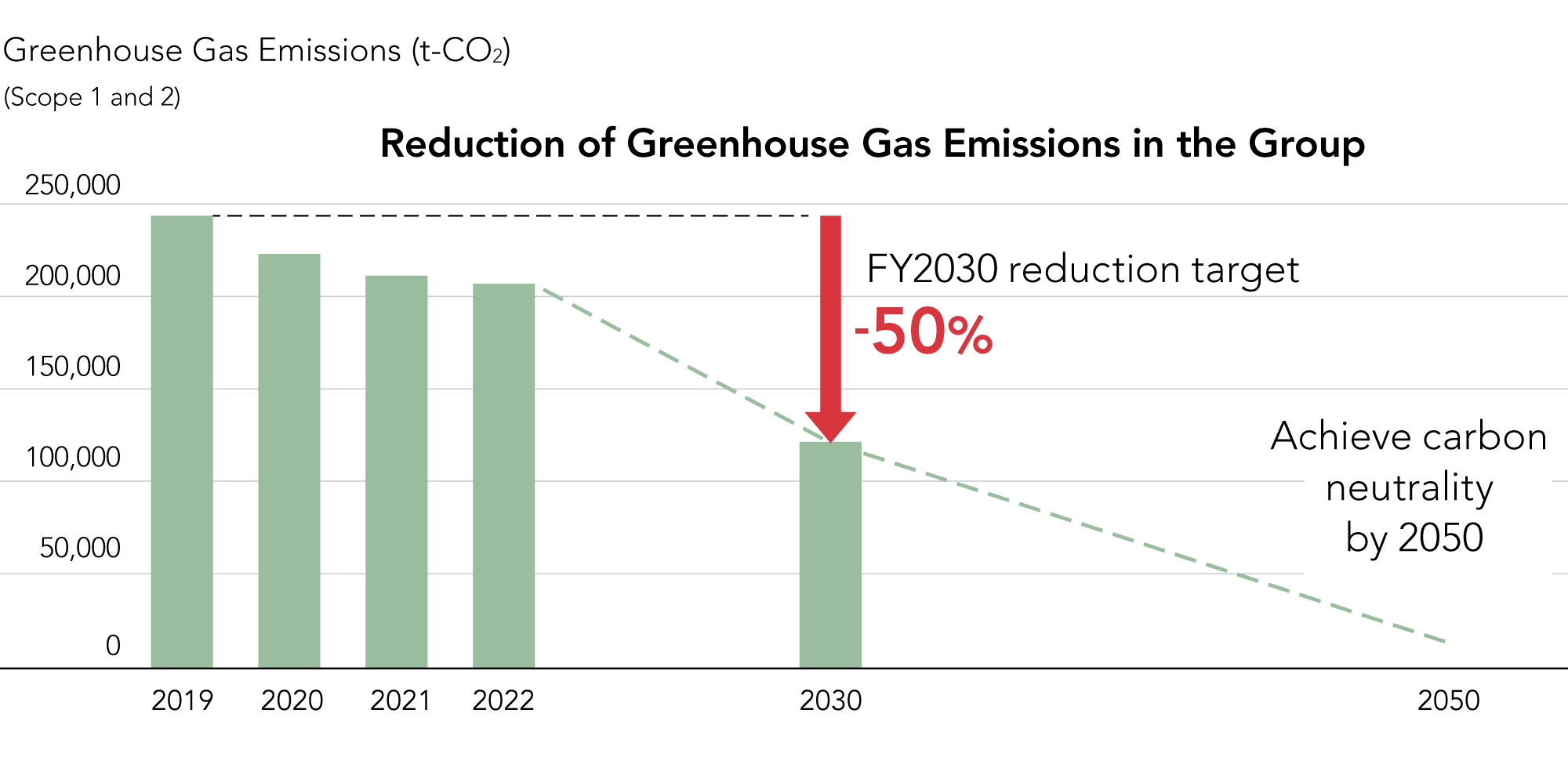

We recognize that climate change can lead to the depletion of forest resources, as well as increased risks associated with global warming and potential financial burden. In addition, we view reducing greenhouse gas emissions across the entire supply chain as a corporate responsibility and have identified “climate change” as a material issue. Our response to climate change has focused mainly on the Paper Manufacturing & Processing segment, where greenhouse gas emissions are high. We have promoted energy efficiency and the utilization of non-fossil energy sources to reduce emissions. Based on greenhouse gas reduction targets set in 2024, we will strengthen our efforts to achieve carbon neutrality by 2050.

Japan Pulp & Paper Group Medium- and Long-term Reduction Targets

for Greenhouse Gas Emissions

Disclosure Based on TCFD Recommendations

The group recognizes that responding to climate change is an urgent issue. In June 2021, we announced our endorsement of the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, and joined the TCFD Consortium. Since then, we have conducted scenario analyses of the risks and opportunities that climate change poses to the group’s businesses, including the Paper and Paperboard Wholesaling, Paper Manufacturing & Processing, Raw Materials & Environment, and Real Estate Leasing segments.* We disclose information on governance, strategy, risk management, and metrics and targets as recommended by the TCFD.

Based on our Sustainability Policy, we will work harder to address climate change and reduce greenhouse gas emissions, and will promptly disclose relevant information.

- While there are five business segments (Japan Wholesaling, Non-Japan Wholesaling, Paper Manufacturing & Processing, Raw Materials & Environment, and Real Estate Leasing), the Japan Wholesaling and Non-Japan Wholesaling segments were treated as the Paper and Paperboard Wholesaling segment for the scenario analysis.

What is the TCFD?

The Task Force on Climate-related Financial Disclosures (TCFD) was established by the Financial Stability Board to study climate-related information disclosure and how financial institutions should respond. Climate change, a global issue, is becoming a factor that has a serious impact on corporations, and is turning into either a risk or an opportunity for mid- to long-term business activities. Under these circumstances, it has become necessary for companies to incorporate the climate change factor into their business strategies in order to achieve sustainable growth. The final TCFD report recommends that companies assess the financial impact of climate change risks and opportunities on their operations and disclose them in four areas: governance, strategy, risk management, and metrics and targets.

What is the TCFD Consortium?

The TCFD Consortium is a group of companies and financial institutions that support the TCFD. It was established in Japan to discuss effective corporate information disclosure and how to use disclosed information to help financial institutions make appropriate investment decisions.

1 Governance

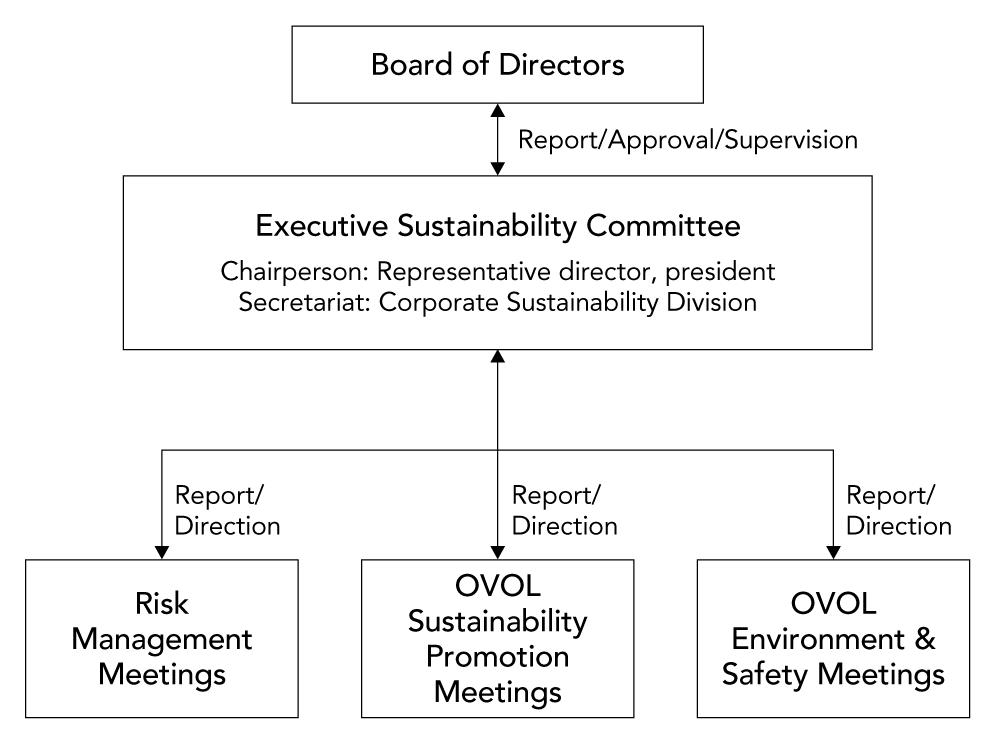

We established the Executive Sustainability Committee with the aim of promoting sustainable business management in a more proactive way. Under the supervision of the Board of Directors, the Executive Sustainability Committee is responsible for formulating policy and planning strategy on all climate change-related matters for the entire group, as well as overseeing the process of finding solutions to ESG issues and meeting our ESG goals. The Executive Sustainability Committee is chaired by the representative director, president, who has ultimate responsibility for management decisions related to climate change. The progress of matters reviewed and discussed by the committee is regularly reported to the Board of Directors, and important matters are resolved by the Board. Matters resolved by the Board of Directors are then directed to the OVOL Sustainability Promotion Meetings and the OVOL Environment & Safety Meetings for implementation at each group site.

Sustainability and Governance Structure

2. Strategies (Risks, Opportunities, and Responses)

The group has identified risks and opportunities associated with climate change in four business segments: the Paper and Paperboard Wholesaling business, Paper Manufacturing & Processing, Raw Materials & Environment, and Real Estate Leasing, using two scenarios developed by the IPCC, IEA, and other specialist organizations: one in which the increase in average temperature is limited to 1.5°C (2.0°C in some scenarios) and another in which the average temperature increase exceeds 4°C. Risks and opportunities posed by climate change are categorized into transition risks associated with the transition to a low-carbon society and the physical impacts of climate change. In order to incorporate these risks and opportunities into our business strategy, we conducted an assessment of the associated financial impacts in the short-term, medium-term, and long-term.

Risks and Opportunities

| Category | Impact on the Company | Countermeasures | Scale of Impact | ||

|---|---|---|---|---|---|

| Risks | Transition | Policies and Regulations | Significant increase in operating costs in the paper manufacturing business due to increased carbon taxes |

|

Large |

| Reputation | Decline in corporate value and loss of stakeholder confidence due to delays in response to climate change, resulting in lower sales revenues, impact on financing ability, and decline in brand value |

|

Moderate | ||

| Physical | Acute | Extensive damage to sites, facilities, inventories, real estate, etc., due to wind and flood damage |

|

Moderate | |

| Suspension of business due to disruptions in the supply chain caused by wind and flood damage, and resulting decline in sales revenues |

|

Moderate | |||

| Chronic | Impact of storm surge and other flooding damage to coastal sites due to rise in sea levels |

|

Moderate | ||

| Opportunities | Market | Contribution to business performance from increased demand for functional materials related to electronic components associated with the advance of electrification |

|

Moderate | |

| Contribution to business performance from increased demand for environment-friendly products such as paper with FSC and PEFC Forest Certification and recycled paper |

|

Moderate | |||

| Contribution to business performance from increased demand for paper products due to move away from plastics |

|

Moderate | |||

- Scale of Impact is categorized as “Large” if the event in question poses a risk to the survival of the business and “Moderate” if a major change in the business strategy is required. Scale of Impact (Large, Moderate) were compiled based on Applying Enterprise Risk Management to Environmental, Social and Governance-related Risks, COSO & WBCSD.

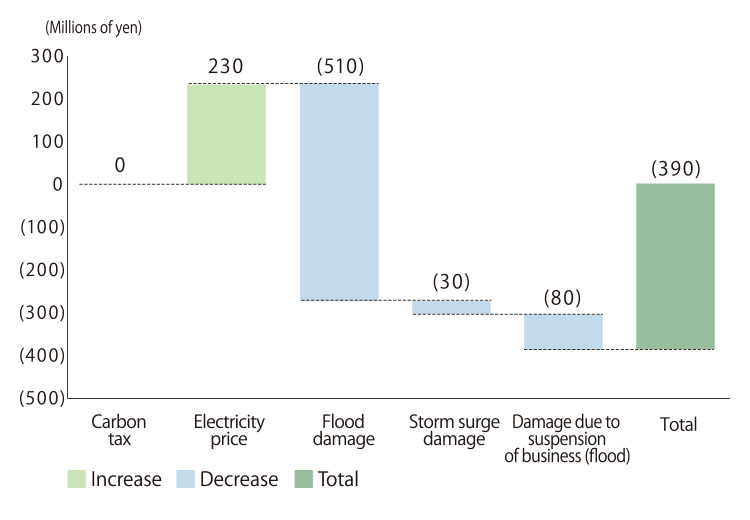

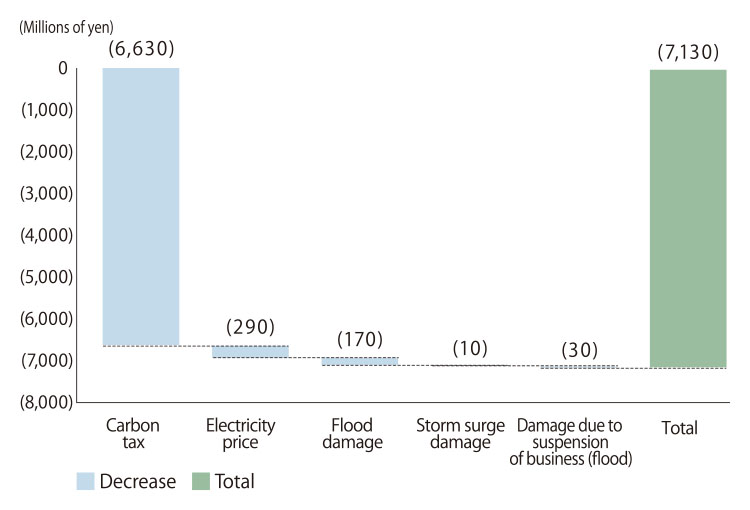

Financial Impact Analysis

Based on the financial impact scenario analysis, we expect that the introduction of a carbon tax would have a significant impact, particularly on the group’s paper manufacturing business. On the other hand, we believe that we can lower that impact by promoting the reduction of greenhouse gas emissions.

In terms of physical risks, we estimate that damage to the main bases of the group in Japan due to abnormal weather events such as floods and typhoons would be in the range of JPY200 million to JPY600 million in the 1.5°C (2°C) and 4°C scenarios. In the event of severe damage to a business partner, there is a possibility that factories in the supply chain would not be able to operate and that the transportation of products, raw materials, and fuel would be disrupted, resulting in damage beyond our estimate.

Analysis Results *1

| Item | Risks | Analysis Content | Financial Impact (2050) | |

|---|---|---|---|---|

| 4°C Scenario | 1.5°C (2°C) Scenario | |||

| Carbon tax | Transition | Impact of carbon tax introduction | - | JPY(6,630) million *2 |

| Electricity price | Transition | Impact of electricity price changes | JPY230 million | JPY(290) million |

| Flood damage | Physical | Annual average flood damage | JPY(510) million | JPY(170) million |

| Storm surge damage | Physical | Annual average storm surge damage | JPY(30) million | JPY(10) million |

| Damage due to suspension of business (flood) | Physical | Annual average damage due to suspension of business (flood) | JPY(80) million | JPY(30) million |

- Analysis of Japan Pulp & Paper Co., Ltd. and consolidated subsidiaries in Japan

- Analysis based on greenhouse gas emissions in fiscal 2019

Referenced Scenarios

| Transition Risks | IEA NZE | Net Zero Emissions by 2050 Scenario (NZE) This scenario assumes that net zero CO2 emissions will be achieved by 2050. |

|---|---|---|

| IEA SDS | Sustainable Development Scenario (SDS) In this scenario, the path to achieving the goal set in the Paris Agreement to “hold the increase in the global average temperature to well below 2°C above pre-industrial levels and pursue efforts to limit the temperature increase to 1.5°C above pre-industrial levels” was analyzed. |

|

| IEA APS | Announced Pledges Scenario (APS) This scenario reflects the ambitions and targets of each member country to reduce emissions, assuming that all the announced pledges of every government are implemented (also includes those that have not yet been implemented). |

|

| IEA STEPS | Stated Policies Scenario(STEPS) This scenario incorporates the current plans of each government, including policy initiatives that have already been announced and implemented around the world. |

|

| IEA B2DS | Beyond 2 Degrees Scenario (B2DS) This scenario assumes there is a 50% probability that the temperature rise in 2060 does not exceed 1.75°C. |

|

| Physical Risks | IPCC RCP2.6 | A scenario that projects a temperature increase of around 2°C compared with pre-industrial levels |

| IPCC RCP8.5 | 4°C scenario with the highest temperature increase |

Parameters Used for Financial Impact Analysis

| Item Name | Standard | Unit | Present | 2050 | Source | ||

|---|---|---|---|---|---|---|---|

| 4℃ | 2℃ | 1.5℃ | |||||

| Carbon Price | Developed countries (With net zero pledge) |

USD/t-CO2 | 0 | 0 | 200 | 250 | IEA WEO 2022 |

| Electricity Price | Japan | USD/MWh | 216 (2018) |

203 (2040) ※ |

232 (2040) ※ |

- | IEA WEO 2019 |

| Flood Rate | Japan | - | - | 4 (2040) ※ |

2 (2040) ※ |

- | Proposal for Flood Control Plans Based on Climate Change (Ministry of Land, Infrastructure, Transport and Tourism) |

| Storm Surge Rate | Japan | - | - | 2 | 1.2 | - | Assessment Report on Climate Change Impacts in Japan (Ministry of the Environment) |

- Analysis of figures for 2040 as there are no parameters for 2050

Financial Impact (Risks) under the 4°C Scenario (2050)

Financial Impact (Risks) under the 1.5°C (2°C) Scenario (2050)

3. Risk Management

The Executive Sustainability Committee identifies risks and opportunities related to climate change for the group as a whole, formulates response plans, instructs corresponding organizations led by the Corporate Sustainability Division, manages progress of measures, and reports to the Board of Directors. The Board of Directors approves the content of reports or gives instructions on improvements, and monitors results to ensure that appropriate risk management is being implemented. Risk matters related to climate change deliberated by the Executive Sustainability Committee are directed to the Risk Management Meetings, the OVOL Environment & Safety Meetings, and the OVOL Sustainability Promotion Meetings, and reflected in the group’s overall risk management.

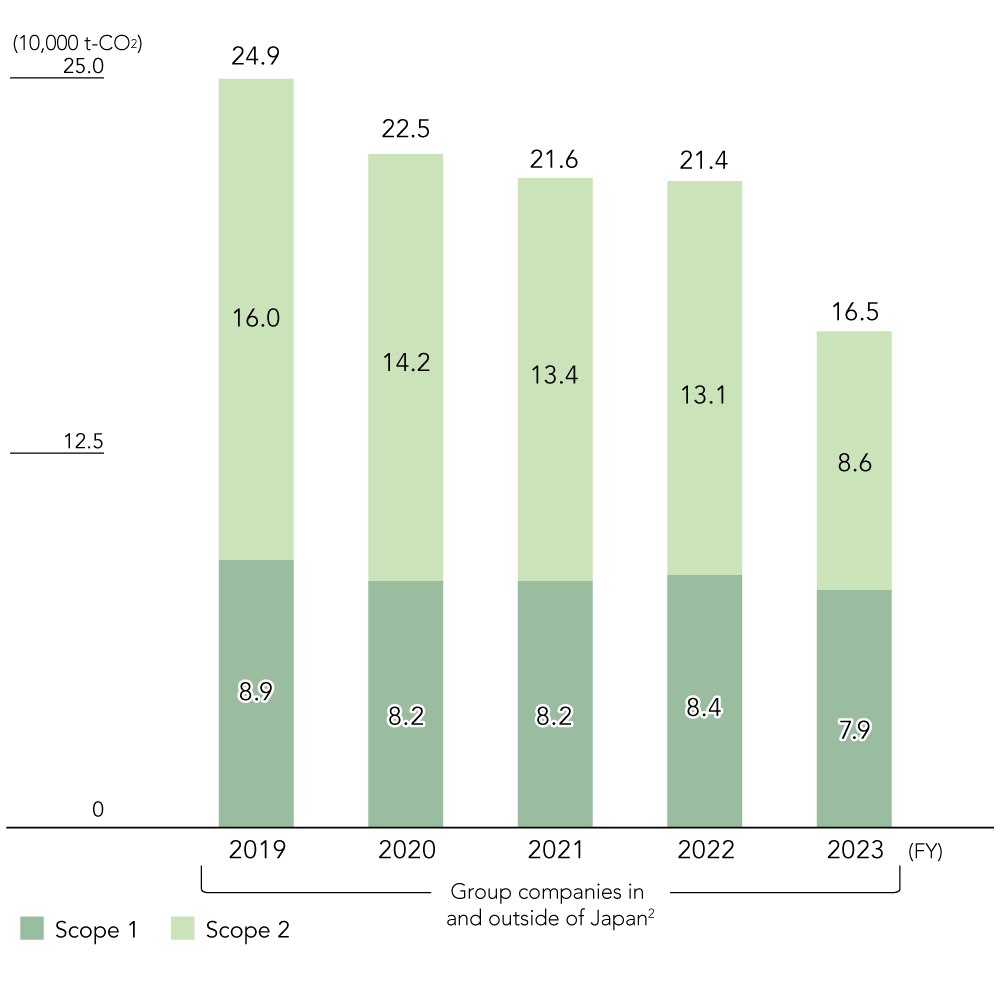

4. Metrics and Targets

In response to climate change, we have set “Japan Pulp & Paper Group Medium- and Long-term Reduction Targets for Greenhouse Gas Emissions.” As part of these efforts, we are implementing various measures to reduce Scope 1 and 2 emissions throughout the group, including switching to biomass boilers and renewable energy, and fundamentally reforming production efficiency through the use of a distributed control system (DCS). As a result, in fiscal 2023 we achieved approximately a 34% reduction in Scope 1 and 2 emissions compared with fiscal 2019 levels.

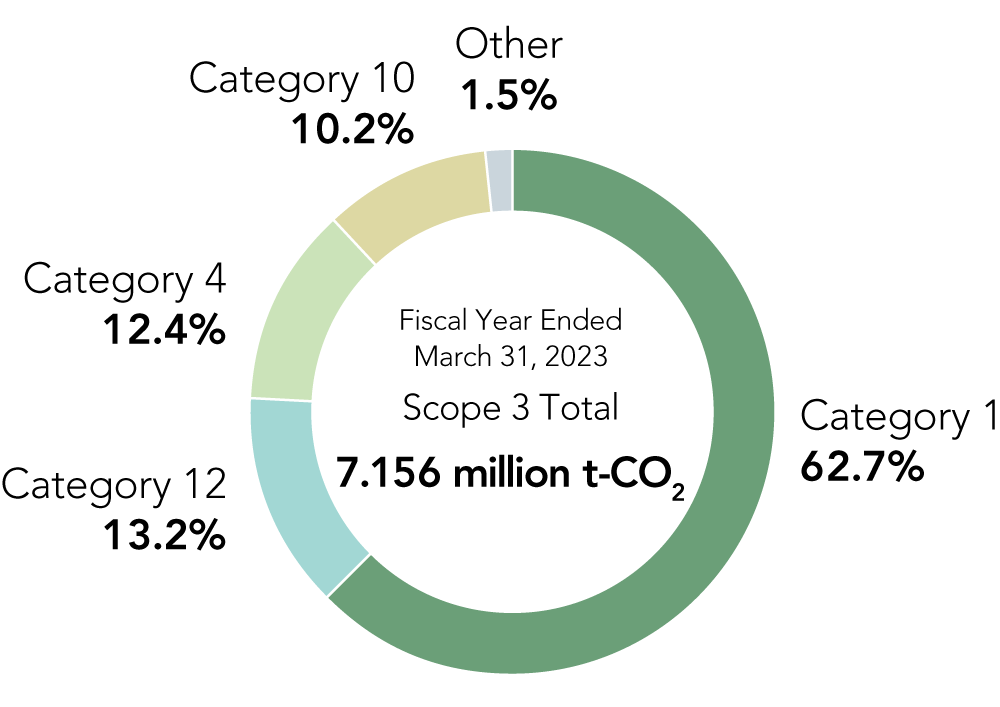

Regarding Scope 3 emissions, since fiscal 2022 we have expanded the scope of calculation from Japan Pulp & Paper to include consolidated subsidiaries. We plan to actively promote reduction initiatives for Scope 3 emissions going forward.

[Related link]

Renewable Energy Power Generation

We launched the biomass power generation business with

the aim of supplying energy and steam to the group’s

paper manufacturing companies. As such, we are working

to ensure a stable supply of clean and safe electricity to

meet growing demand from society. In 2016, we began

operation of a woody biomass power plant (power output:

14 MW) in Noda Village, Iwate Prefecture. In collaboration

with regional governments, we are developing projects that

benefit the public interest and lead to the revitalization of

local industries. We also operate a solar power generation

business in Kushiro, Hokkaido (power output: 20 MW) and

supply the electricity it generates.

In 2018, we established OVOL New Energy, a company

that collects palm kernel shells (PKS) in Malaysia for export,

creating a system for the stable supply of biomass fuel.

Introduction of Renewable Energy at Group Companies

In fiscal 2023, both Eco Paper JP, which manufactures

containerboard and printing paper, and Taiho Paper, which

also manufactures containerboard, began using electricity

from renewable energy sources to help reduce greenhouse

gas emissions. Both companies have long promoted CO2

reduction through the use of woody biomass power

generation, but are now taking their efforts a step further by

switching the electricity they purchase to hydroelectric

power. Eco Paper JP has achieved a renewable energy

use rate of 50%, while Taiho Paper has achieved 100%.

In addition, group companies are in the process of

introducing EV trucks, EV forklifts, and fuel cell electric

vehicles (FCEVs) as part of our efforts to achieve carbon

neutrality by 2050.

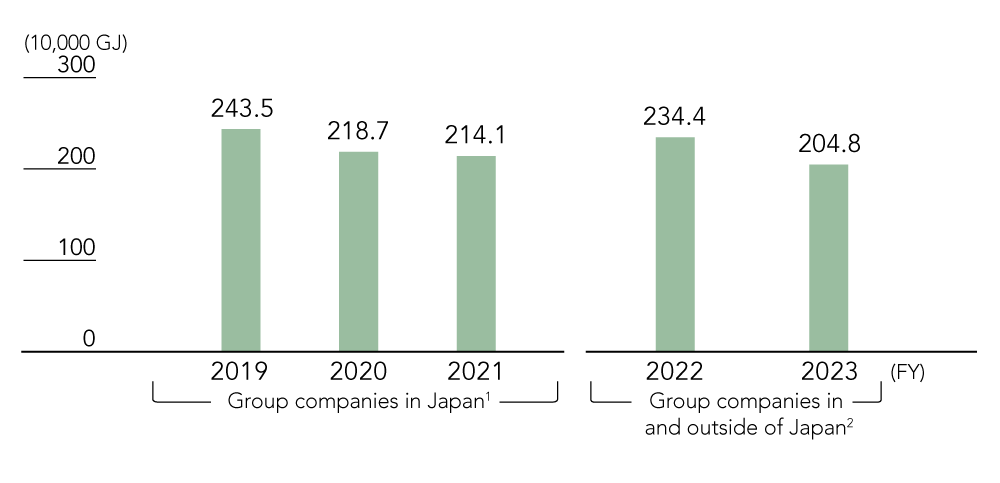

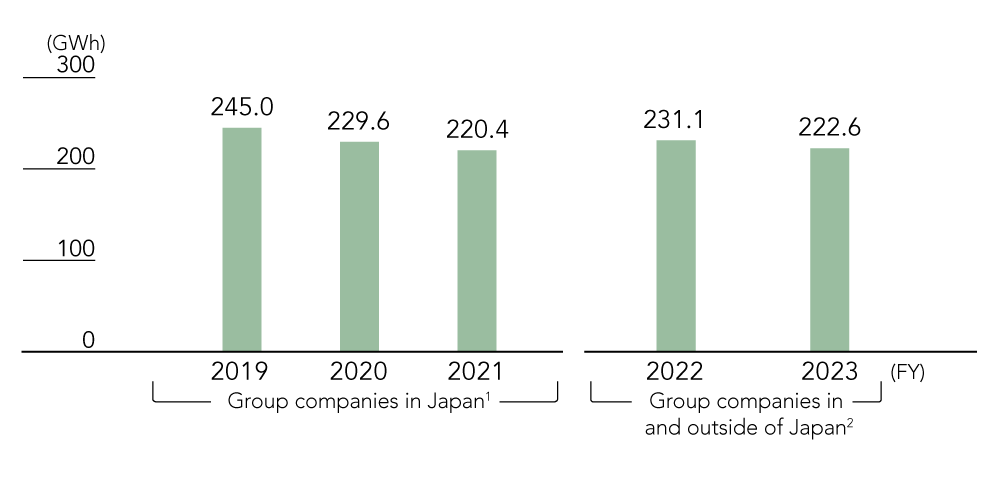

Climate Change-related Data

Energy Consumption

Electricity Consumption

Greenhouse Gas Emissions (3,4,5,6)

- Japan Pulp & Paper and consolidated subsidiaries in Japan

- Japan Pulp & Paper and consolidated subsidiaries in and outside of Japan

- Figures for subsidiaries outside of Japan for 2019 to 2021 are estimated based on 2022 emissions.

- Calculated in accordance with the standards of the GHG Protocol. The coefficients used for calculations are based on Japan’s Act on Promotion of Global Warming Countermeasures.

- Scope 1 and 2 GHG emissions have been refined and recalculated retroactively to 2019.

- Third-party verification of Scope 1 and 2 GHG emissions (parent company) for FY2021, FY2022, and FY2023 has been conducted by the Japan Management Association GHG Certification Center.

Scope 3 Breakdown (Consolidated)

(Unit: 10,000 t-CO2)

| Item | Fiscal year ended March 31, 2022 | |

|---|---|---|

| Purchased goods and services | 448.8 | |

| Capital goods | 1.0 | |

| Fuel- and energy-related activities | 4.7 | |

| Upstream transportation and distribution | 89.0 | |

| Waste generated in operations | 0.1 | |

| Business travel | 0.0 | |

| Employee commuting | 0.2 | |

| Upstream leased assets | - | |

| Downstream transportation and distribution | 1.3 | |

| Processing of sold products | 72.6 | |

| Use of sold products | 0.7 | |

| End-of-life treatment of sold products | 94.6 | |

| Downstream leased assets | 2.5 | |

| Franchises | - | |

| Investments | - | |

| Scope 3 Total | 715.6 | |

- Calculation standard: Ministry of the Environment’s “Corporate Value Chain (Scope 3)

Accounting and Reporting Standard” and “GHG protocol: Technical Guidance for Calculating Scope 3 Emissions” - Excluded categories: There are no relevant activities for categories 8, 14, and 15

Sustainability

-

Sustainable Management

-

Employees

- Work Environment

- Health Management Policy

- Occupational Health and Safety Policy

- Diversity and Inclusion

- Japan Pulp & Paper Executive & Employee Health Management

- General Business Owners Action Plan based on the Act on Promotion of Women’s Participation and Advancement in the Workplace

- Announcement of mid-career recruitment ratio based on the "Comprehensive Promotion Law on Labor Policy"

- General Business Owner Action Plans based on the "Next-Generation Support Measures Promotion Act"